Legacy Tools Leave PCI Data at Risk and Audits in Chaos

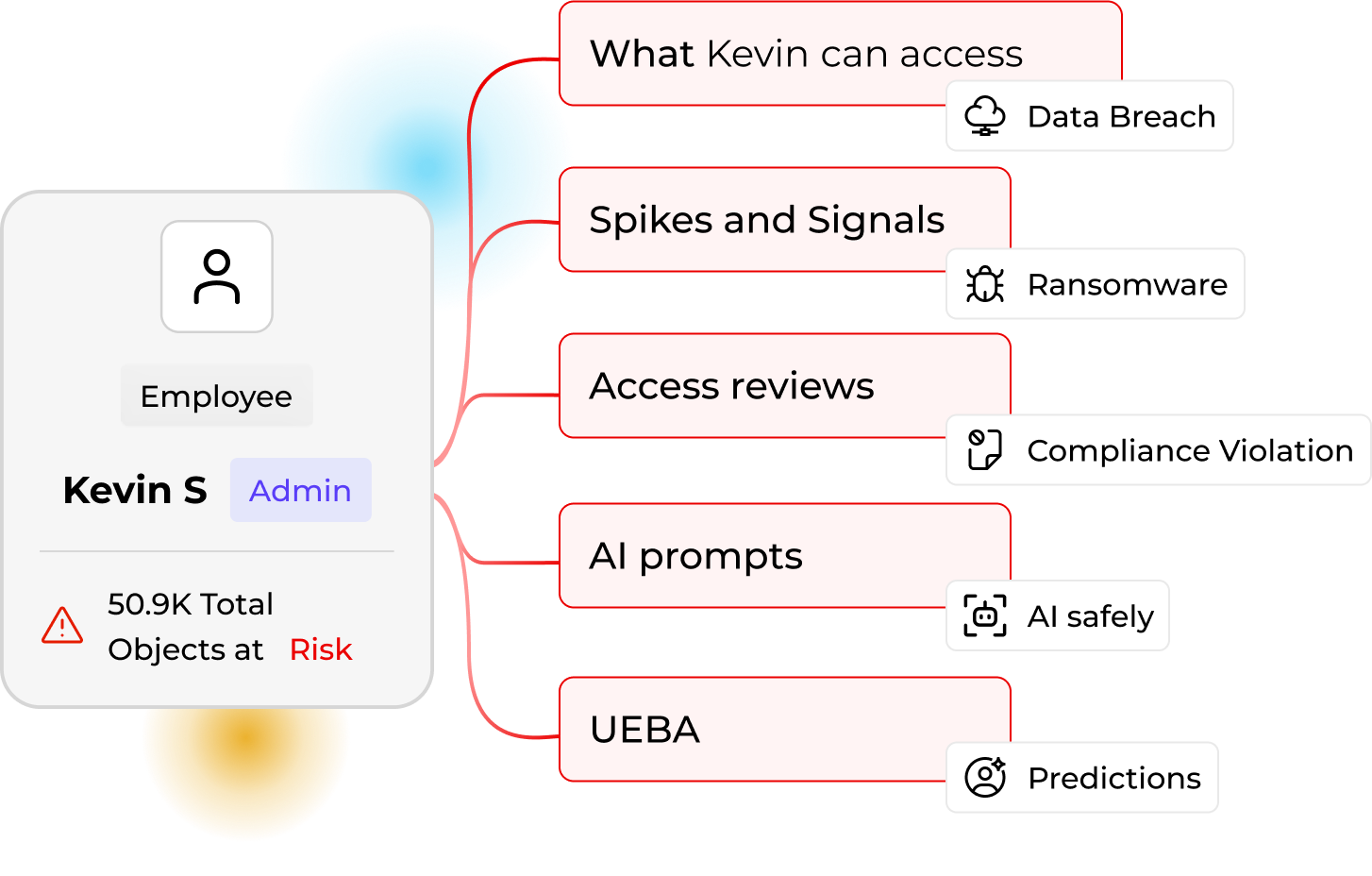

Cardholder Data Is Everywhere

PAN and CVV data can hide in files, chats, and apps outside traditional controls.

Access Is Hard to Track

Over-permissioned folders keep PANs one click from breach, breaking least privilege and Req 7.

Audits Are Manual and Painful

Proving PCI compliance requires hours of spreadsheet wrangling and screenshots.

Faster PCI Compliance with Less Manual Effort

90%

Risk exposure reduced

Organizations cut risk by remediating open access and mapping data to identities.

80%

Faster audits

PCI reporting went from manual to instant, streamlining compliance preparation.

70%

Cost reduction

Automated discovery and remediation freed teams to focus on strategic work.

“We chose Lightbeam because it offered granular control and unique insights into sensitive data, including the ability to identify the identities behind it.”

David Hanna

IT Security, Veridian Credit Union

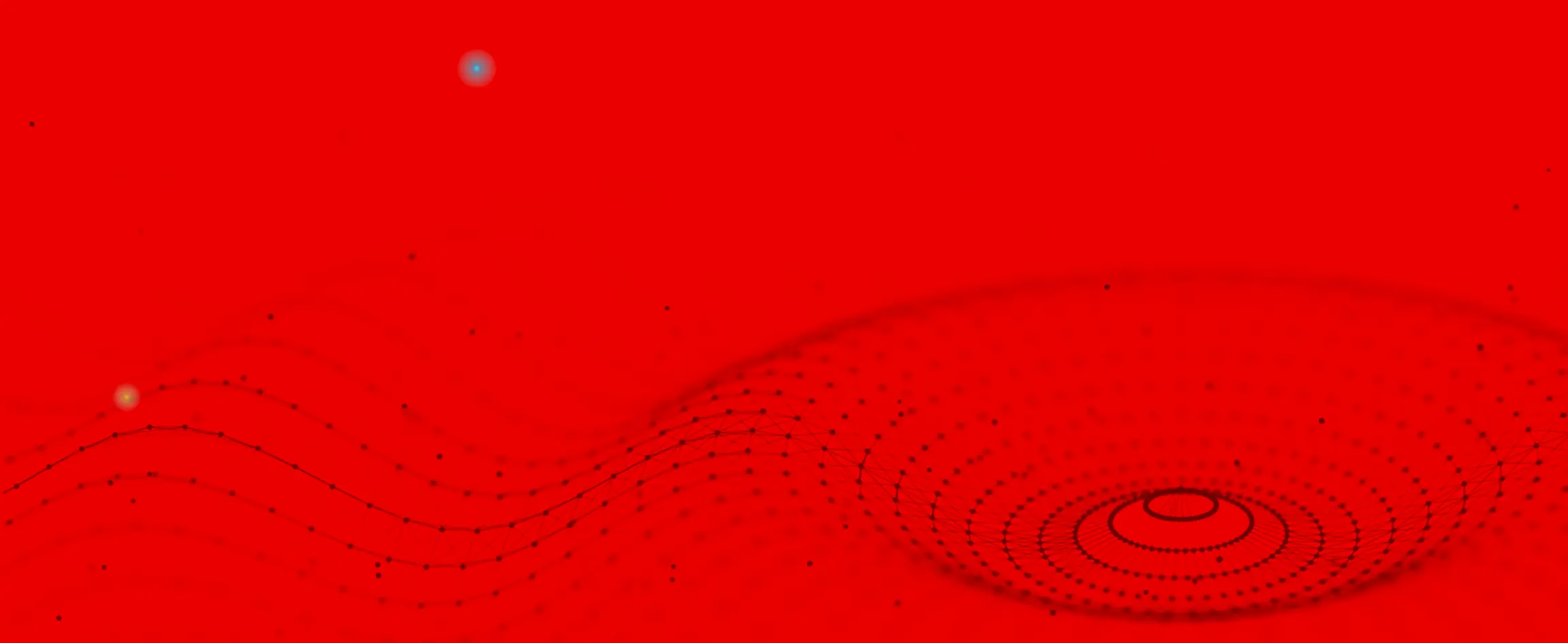

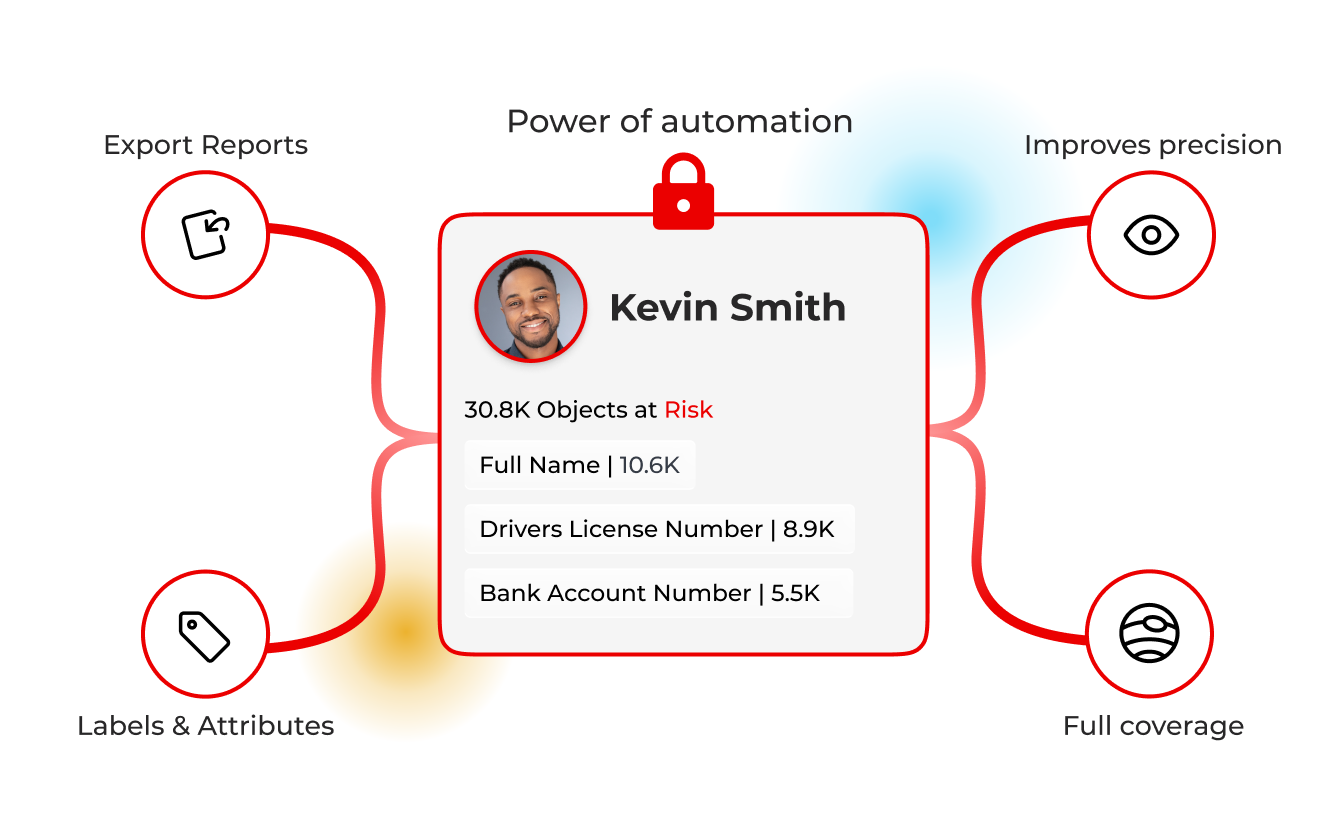

Automate PCI Compliance with Identity-Aware Controls

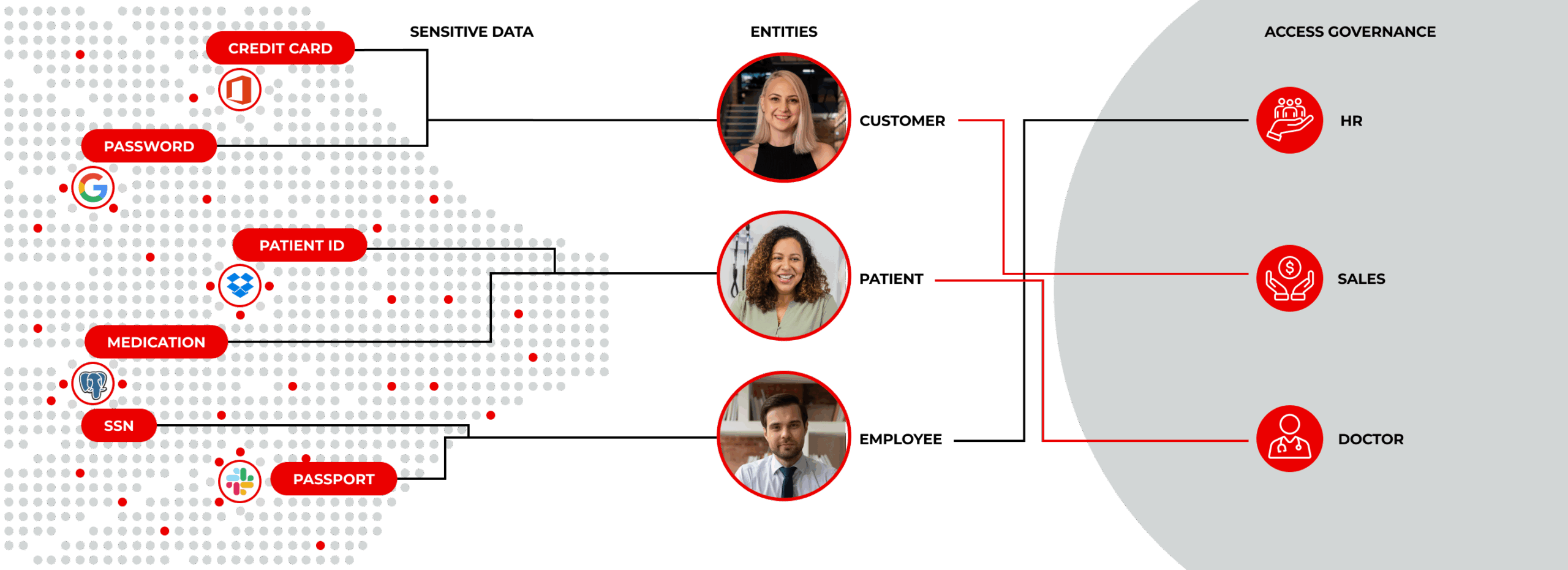

Discover Cardholder Data

Classify every Primary Account Number and link it to the issuing entity, owner, and business process, no regex tuning required.

Explore Data ClassificationLeast-Privilege Access

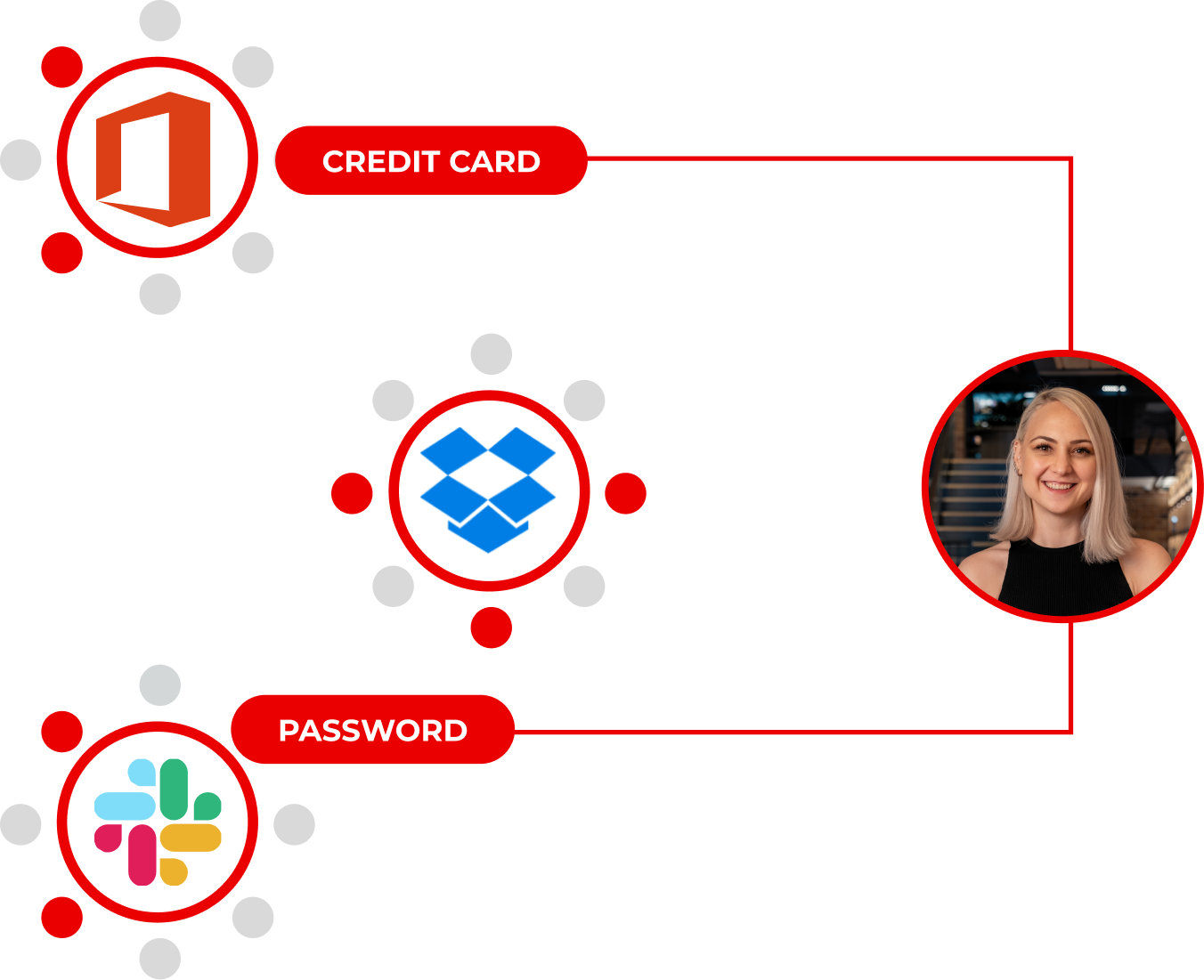

Detect open shares, excessive permissions, and stale accounts, then trigger policy-based revocation to enforce Requirement 7 automatically.

Explore Access GovernanceRetention Policy Automation

Map expiry rules to cardholder data and launch delete, mask, or archive workflows the moment retention windows close.

Explore Automated RemediationAudit-Ready Reporting

Generate detailed reports on access controls, encryption status, and remediation actions—ready for auditors at any time.

Explore Access Governance

Discover, Protect, and Prove PCI Compliance Automatically

Lightbeam finds cardholder data across all environments, maps it to identities, applies access and governance policies, and generates audit-ready PCI reports, continuously and at scale.

Stay ahead of every mandate. Beyond PCI-DSS: Your Global Compliance Toolkit

GDPR

Lightbeam automates RoPA, PIA, and DSR workflows, giving European regulators the evidence they demand while your team focuses on innovation, not inboxes.

Learn MoreCCPA

Automate consumer disclosures and opt-outs, validate deletion and monitor data sharing to stay ahead of California enforcement.

Learn MoreHIPAA

Link PHI to patient identities, detect overshared records in email or SharePoint, and auto redact violations to protect care continuity and avoid fines

Learn MoreQuébec Law 25

Automate Québec Law 25 privacy compliance with Lightbeam, identity-aware data discovery, PIAs, DSRs, and real-time governance in one platform.

Learn MoreProof from teams like yours.

FAQs

Frequently Asked Questions

Does the Lightbeam platform store our cardholder data?

No. Deploy Lightbeam in your own cloud or on-premises datacenter. No data or metadata leaves your environment.

Explore Our PlatformHow fast can we reach PCI readiness after deploying Lightbeam?

Most customers generate a complete inventory and preliminary gap report within the first 24 hours, then use automated workflows to remediate findings based on risk profile from there.

Explore Automated RemediationCan Lightbeam help us maintain compliance between annual assessments?

Yes. Continuous scans, risk scoring, and real-time alerts keep you informed of new data, access changes, and retention violations, so evidence is always fresh.

Explore Risk ScoringKey Resources & Events

Blog

Colorado Privacy Act (CPA): Key Compliance Requirements and Consumer Rights